FTB California, or the Franchise Tax Board, is a vital state agency responsible for administering California's tax laws and ensuring compliance among taxpayers. This article delves deep into the workings, responsibilities, and significance of the FTB, providing valuable insights for individuals and businesses alike.

When it comes to tax obligations, understanding the role of government agencies is crucial. For residents and businesses in California, the Franchise Tax Board plays a pivotal role in managing state taxes and ensuring financial transparency. Whether you're an individual taxpayer or a business owner, having a clear understanding of FTB California can help you navigate the complexities of state tax regulations.

In this guide, we will explore various aspects of FTB California, including its history, functions, and key services. Additionally, we will provide practical advice and resources to help you stay compliant with state tax laws. By the end of this article, you'll have a comprehensive understanding of how the Franchise Tax Board operates and how it impacts your financial responsibilities.

Read also:Taylor Earnhardt Rising Star In The Nascar World

Table of Contents

- Overview of FTB California

- History of FTB California

- Functions and Responsibilities

- Tax Filing and Payment

- Business Taxes in California

- Understanding Penalties and Interest

- Appeals Process

- Resources and Tools

- Frequently Asked Questions

- Conclusion

Overview of FTB California

FTB California is the primary agency responsible for administering tax laws in the state. Established to ensure fair and efficient tax collection, the Franchise Tax Board plays a critical role in maintaining the financial health of California. Its mission is to promote voluntary compliance with tax laws while providing taxpayers with the tools and resources they need to meet their obligations.

Key Responsibilities of FTB

- Administering personal income tax, corporate income tax, and other related taxes.

- Providing taxpayer services, including assistance with tax forms and payment options.

- Enforcing tax laws through audits and investigations.

- Issuing refunds and managing taxpayer accounts.

The agency's focus on transparency and accountability ensures that taxpayers are treated fairly and equitably. By staying informed about FTB California's operations, individuals and businesses can better manage their tax responsibilities.

History of FTB California

The Franchise Tax Board was established in 1955 to replace the California Tax Commission. Since then, it has evolved to become one of the most effective tax agencies in the United States. Over the years, FTB California has implemented numerous reforms to improve efficiency and enhance taxpayer services.

One of the significant milestones in its history was the introduction of electronic filing in the 1990s, which revolutionized the way taxpayers submitted their returns. This innovation not only streamlined the process but also reduced errors and processing times.

Evolution of FTB Services

Today, FTB California continues to adapt to changing economic conditions and technological advancements. The agency's commitment to innovation ensures that taxpayers have access to cutting-edge tools and resources to manage their tax obligations effectively.

Functions and Responsibilities

The Franchise Tax Board performs a wide range of functions to ensure compliance with California's tax laws. These functions include:

Read also:Wyatt Duke Mcpartlin A Rising Star In The Entertainment Industry

- Tax Collection: Collecting personal and corporate income taxes, as well as other related taxes.

- Taxpayer Assistance: Providing guidance and support to help taxpayers understand and fulfill their obligations.

- Enforcement: Conducting audits and investigations to address non-compliance issues.

- Refund Processing: Issuing refunds to taxpayers who overpay their taxes.

Each of these functions is designed to promote fairness and transparency in the tax system. By fulfilling its responsibilities effectively, FTB California contributes to the economic stability of the state.

How FTB Ensures Compliance

The agency employs a variety of strategies to ensure that taxpayers comply with state tax laws. These include regular audits, data matching, and collaboration with other government agencies. Through these efforts, FTB California helps to prevent tax evasion and ensure that all residents contribute their fair share to the state's coffers.

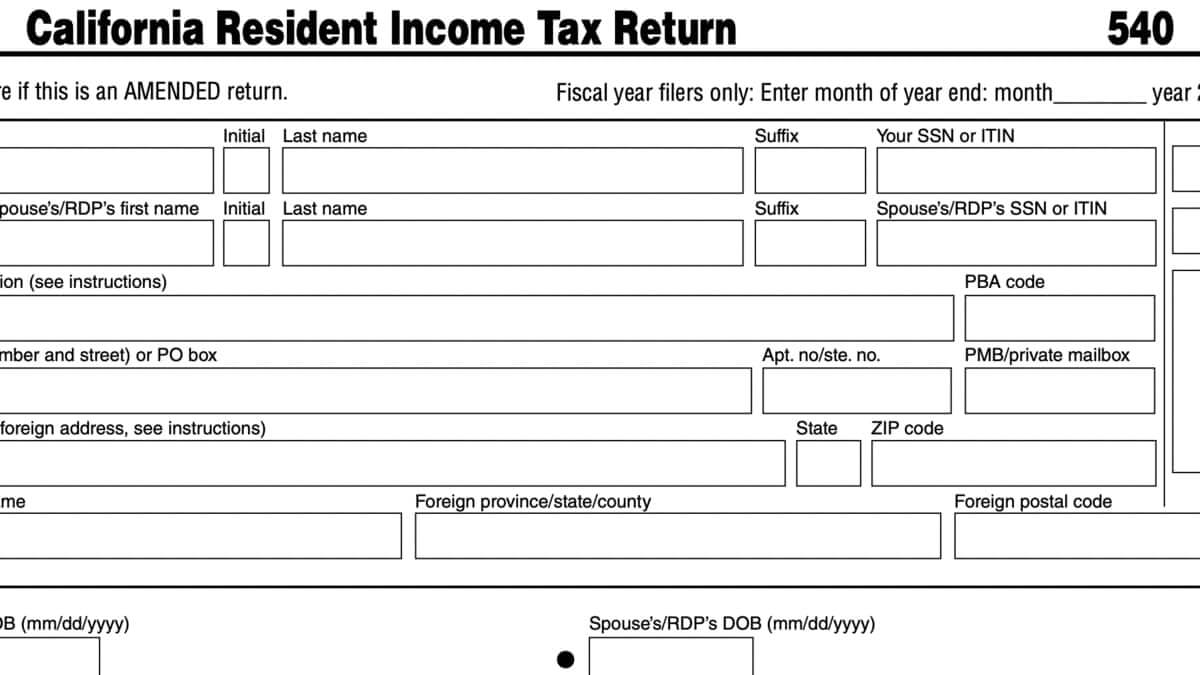

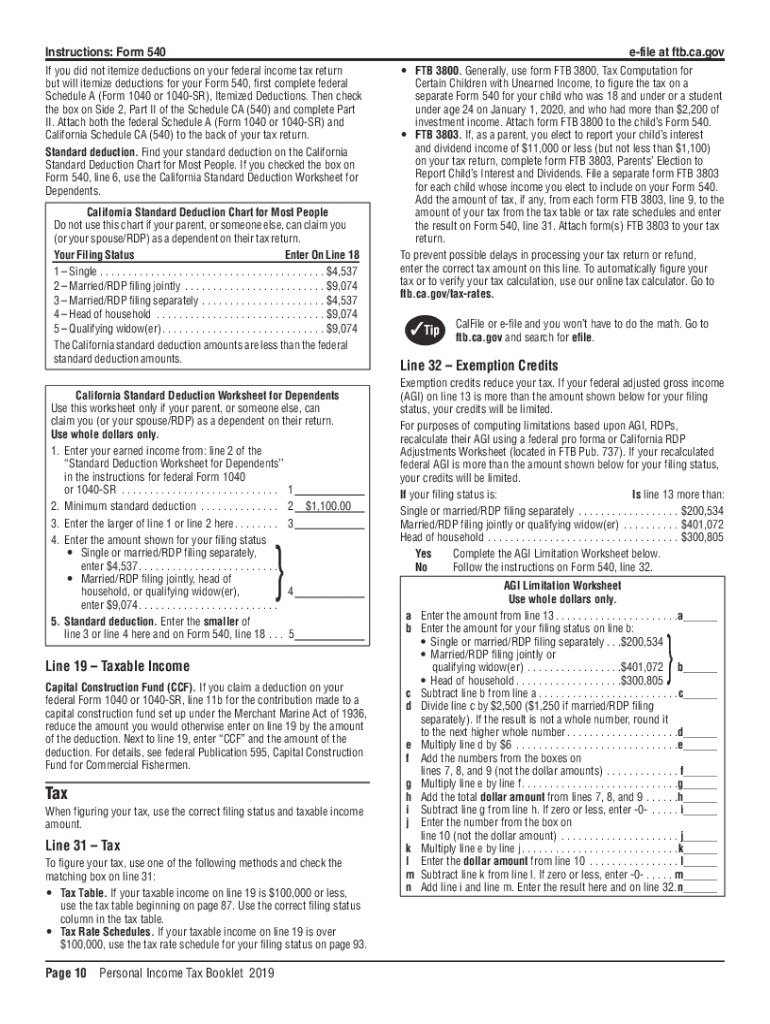

Tax Filing and Payment

One of the primary responsibilities of FTB California is overseeing the tax filing process for individuals and businesses. Taxpayers must submit their returns by the designated deadline, which is typically April 15th each year. Failure to file on time can result in penalties and interest charges.

FTB California offers multiple options for filing and paying taxes, including:

- Online Filing: Through the agency's secure website, taxpayers can submit their returns electronically.

- Mail-In Filing: Taxpayers can also submit paper forms by mail.

- Payment Options: Payments can be made via electronic funds transfer, credit/debit card, or check.

Tips for Filing Taxes

To ensure a smooth filing process, it's essential to gather all necessary documents and information beforehand. This includes W-2 forms, 1099 forms, and any other relevant records. Additionally, double-checking your calculations and ensuring all information is accurate can help prevent errors and delays.

Business Taxes in California

For businesses operating in California, understanding the tax obligations imposed by FTB California is crucial. The agency administers several types of business taxes, including:

- Corporate income tax

- Franchise tax

- Withholding tax

Businesses must file annual returns and pay applicable taxes based on their income and activities. Non-compliance with these requirements can lead to significant penalties and legal consequences.

Key Considerations for Businesses

Business owners should familiarize themselves with FTB California's regulations and deadlines to ensure timely compliance. Additionally, consulting with a tax professional or accountant can help businesses navigate complex tax issues and optimize their financial strategies.

Understanding Penalties and Interest

Failure to comply with FTB California's requirements can result in penalties and interest charges. These penalties are designed to encourage timely filing and payment of taxes. Common penalties include:

- Failure-to-file penalty: 5% of unpaid tax per month, up to a maximum of 25%.

- Failure-to-pay penalty: 0.5% of unpaid tax per month, with no maximum limit.

Interest is also charged on unpaid taxes at a rate determined by the FTB. Understanding these penalties can help taxpayers avoid costly mistakes and maintain compliance with state tax laws.

Avoiding Penalties

To avoid penalties, taxpayers should file their returns and pay their taxes on time. Additionally, maintaining accurate records and seeking professional advice when needed can help prevent errors and ensure compliance.

Appeals Process

If a taxpayer disagrees with an FTB decision, they have the right to appeal. The appeals process involves several steps, including submitting a written request and providing supporting documentation. Taxpayers may also request a conference with an FTB appeals officer to discuss their case.

The appeals process is designed to ensure that taxpayers have a fair opportunity to challenge FTB decisions. By following the proper procedures and presenting a strong case, taxpayers can resolve disputes and achieve favorable outcomes.

Steps in the Appeals Process

- Submit a written appeal within the specified timeframe.

- Gather and submit relevant documentation to support your case.

- Participate in a conference with an FTB appeals officer if requested.

Resources and Tools

FTB California provides a wealth of resources and tools to assist taxpayers in managing their tax obligations. These include:

- Online Account Access: Taxpayers can view their account information, make payments, and update their details through the FTB website.

- Tax Forms and Publications: The agency offers a wide range of forms and publications to help taxpayers understand their responsibilities.

- Customer Service: FTB provides phone and email support to address taxpayer questions and concerns.

By leveraging these resources, taxpayers can stay informed and compliant with state tax laws.

Utilizing FTB Resources

Taxpayers should take advantage of the resources provided by FTB California to simplify the tax filing process. Regularly checking the agency's website for updates and announcements can help ensure that you remain informed about any changes to tax laws or procedures.

Frequently Asked Questions

Q: What is the deadline for filing taxes with FTB California?

A: The deadline for filing taxes with FTB California is typically April 15th each year. However, extensions may be granted under certain circumstances.

Q: How can I pay my taxes online?

A: You can pay your taxes online through the FTB California website using electronic funds transfer, credit/debit card, or other approved methods.

Q: What should I do if I receive a notice from FTB California?

A: Carefully review the notice and respond promptly. If you disagree with the notice, consider filing an appeal or consulting with a tax professional for guidance.

Conclusion

In conclusion, understanding FTB California and its role in administering state tax laws is essential for all residents and businesses in California. By staying informed about the agency's functions and responsibilities, taxpayers can better manage their obligations and avoid penalties.

We encourage you to take advantage of the resources and tools provided by FTB California to simplify the tax filing process. Additionally, consider sharing this article with others who may benefit from the information. For more insights and guidance on tax-related topics, explore our other articles on our website.