Understanding New York State tax is crucial for residents, businesses, and visitors alike. Whether you're filing personal income taxes, managing sales tax, or exploring property tax obligations, staying informed is key to financial stability and compliance. In this article, we'll break down everything you need to know about New York State tax, ensuring you're well-prepared for any tax-related situations.

New York State tax encompasses a wide range of tax obligations, including income tax, sales tax, property tax, and more. Each of these areas plays a vital role in shaping the financial landscape for individuals and businesses. By diving into the details, you'll gain a clearer understanding of how these taxes affect you and how to navigate them effectively.

This guide is designed to be both informative and actionable, providing you with practical insights and expert advice. Whether you're a first-time filer or a seasoned taxpayer, the information here will help you make informed decisions and avoid common pitfalls. Let's get started!

Read also:Carrie Underwood A Journey Of Talent And Resilience

Table of Contents

- Introduction to New York State Tax

- Income Tax Overview

- Sales Tax Details

- Property Tax Explained

- Business Tax Requirements

- Tax Exemptions and Deductions

- Filing Your New York State Tax

- Penalties and Interest

- Resources and Support

- Conclusion and Next Steps

Introduction to New York State Tax

New York State tax is a critical component of the state's revenue system, influencing both personal and business finances. Understanding the various types of taxes and their implications is essential for ensuring compliance and optimizing financial health.

Key Areas of Focus:

- Income Tax

- Sales Tax

- Property Tax

- Business Tax

Each of these areas requires attention to detail and adherence to regulations set forth by the New York State Department of Taxation and Finance. Staying informed can help you avoid unnecessary penalties and make the most of available deductions.

Income Tax Overview

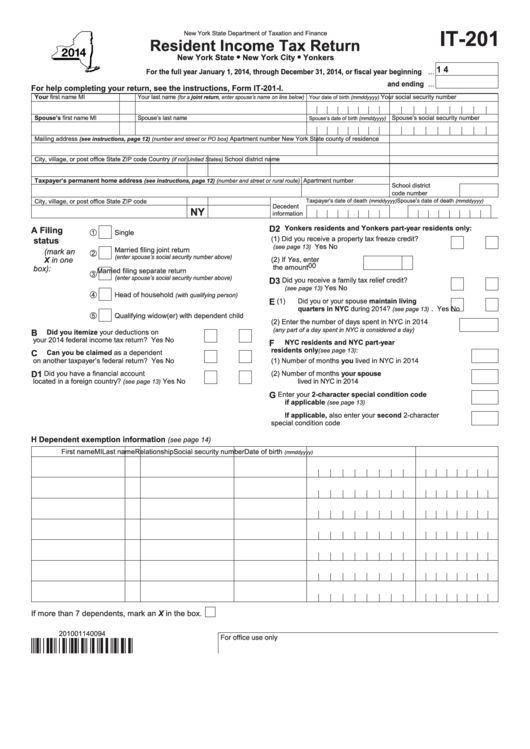

Understanding Personal Income Tax

New York State personal income tax applies to individuals earning income within the state. The tax rates vary based on income levels, with progressive brackets designed to ensure fair taxation.

Income Tax Rates:

- 4% for income up to $8,500

- 4.5% for income between $8,501 and $11,700

- Higher rates for higher income brackets

Key Considerations for Filing

When filing your New York State income tax, it's important to gather all necessary documentation, including W-2 forms, 1099 forms, and any applicable deductions. Consulting with a tax professional can help ensure accuracy and maximize your return.

Read also:Steven Bartlett Wife A Comprehensive Look Into Their Relationship And Life Together

Sales Tax Details

Sales tax in New York State is a significant revenue source, affecting consumers and businesses alike. The standard sales tax rate is 4%, with additional local taxes varying by county and city.

Common Sales Tax Exemptions:

- Clothing and footwear under $110

- Certain groceries

- Prescription medications

Understanding these exemptions can help you save money and make informed purchasing decisions.

Property Tax Explained

Overview of Property Tax

Property tax in New York State is assessed on real estate properties, including residential, commercial, and industrial properties. The tax rate varies by location, with assessments conducted by local governments.

Assessment and Appeals

If you believe your property tax assessment is inaccurate, you have the right to appeal. Gathering evidence and consulting with a property tax expert can strengthen your case and potentially reduce your tax burden.

Business Tax Requirements

Businesses operating in New York State must comply with various tax obligations, including corporate income tax, sales tax, and payroll tax. Each type of tax has specific requirements and deadlines that must be met to avoid penalties.

Key Business Taxes:

- Corporate Income Tax

- Sales Tax

- Payroll Tax

Staying organized and maintaining accurate records is crucial for businesses to ensure compliance and optimize tax planning.

Tax Exemptions and Deductions

Exploring Available Exemptions

New York State offers several tax exemptions and deductions to help taxpayers reduce their overall tax liability. These include exemptions for seniors, veterans, and individuals with disabilities, as well as deductions for education expenses and mortgage interest.

Maximizing Deductions

To maximize your deductions, it's important to keep detailed records and itemize your expenses where applicable. Consulting with a tax advisor can help you identify additional opportunities for savings.

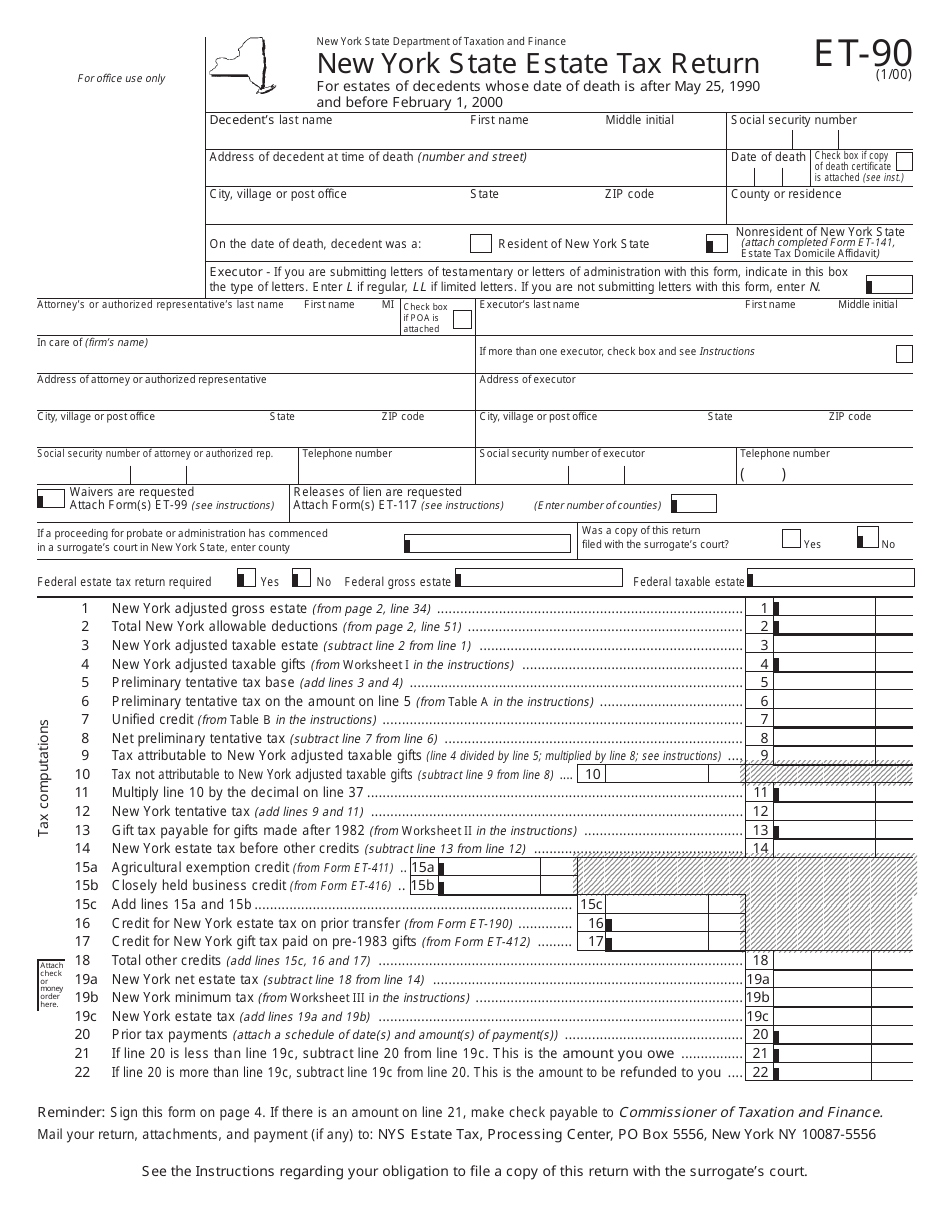

Filing Your New York State Tax

Filing your New York State tax can be done electronically or through traditional mail. Electronic filing offers several advantages, including faster processing times and reduced risk of errors.

Steps to File:

- Gather all necessary documentation

- Choose your filing method

- Review and submit your return

Ensuring accuracy and timeliness in your filing process can help you avoid penalties and ensure timely refunds.

Penalties and Interest

Failing to file or pay your New York State taxes on time can result in penalties and interest charges. These charges can accumulate quickly, making it essential to address any issues promptly.

Common Penalties:

- Failure to file

- Failure to pay

- Underpayment penalties

Understanding these penalties and taking proactive steps to address them can help you avoid unnecessary financial burdens.

Resources and Support

Several resources are available to assist taxpayers in understanding and managing their New York State tax obligations. The New York State Department of Taxation and Finance website provides comprehensive information and tools to help you navigate the tax process.

Additional Support:

- Tax professionals and advisors

- Local tax offices

- Online resources and calculators

Taking advantage of these resources can help you stay informed and confident in your tax management.

Conclusion and Next Steps

In conclusion, understanding New York State tax is essential for ensuring compliance and optimizing your financial health. By familiarizing yourself with the various types of taxes, exemptions, and filing requirements, you can make informed decisions and avoid common pitfalls.

We encourage you to take the following steps:

- Review your tax obligations and gather necessary documentation

- Consult with a tax professional for personalized advice

- Stay informed by utilizing available resources and support

Feel free to share this article with others who may benefit from the information, and don't hesitate to leave a comment or question below. Together, we can ensure a smoother tax experience for everyone!