Delta Dental Insurance is one of the leading providers of dental benefits in the United States, catering to millions of individuals and businesses. Whether you're seeking affordable dental care or exploring options for comprehensive coverage, Delta Dental offers a wide range of plans designed to meet diverse needs. Understanding how Delta Dental works and its various offerings can help you make informed decisions about your oral health.

Good dental health is not only essential for maintaining a beautiful smile but also plays a crucial role in overall well-being. Dental insurance has become an integral part of healthcare planning, and Delta Dental is at the forefront of providing quality coverage. With its extensive network of dentists and tailored plans, Delta Dental ensures that individuals and families receive the care they deserve.

Whether you're a first-time user or looking to switch providers, this guide aims to provide in-depth insights into Delta Dental Insurance. From understanding the basics of dental insurance to exploring the benefits of Delta Dental plans, we’ll cover everything you need to know. Let’s dive in!

Read also:Steven Bartlett Wife A Comprehensive Look Into Their Relationship And Life Together

Table of Contents

- Introduction to Delta Dental Insurance

- How Delta Dental Insurance Works

- Types of Delta Dental Insurance Plans

- Delta Dental's Network of Dentists

- Coverage Benefits and Exclusions

- Cost Considerations for Delta Dental Plans

- Eligibility Requirements for Delta Dental Insurance

- How to Enroll in Delta Dental Insurance

- Delta Dental Customer Support

- Conclusion: Why Choose Delta Dental?

Introduction to Delta Dental Insurance

Delta Dental Insurance has been a trusted name in dental benefits for over six decades. Founded in 1955, the company has grown to become the largest provider of dental insurance in the U.S., serving over 90 million enrollees. Delta Dental operates through a network of independent companies, ensuring localized services while maintaining national standards.

One of the key strengths of Delta Dental is its commitment to affordability and accessibility. The company offers a variety of plans tailored to meet the needs of individuals, families, and businesses. With a vast network of participating dentists, Delta Dental ensures that policyholders receive quality care without breaking the bank.

Delta Dental’s mission is to improve the oral health of all Americans by providing innovative dental benefits and promoting preventive care. By investing in cutting-edge technology and partnering with leading dental professionals, Delta Dental continues to lead the industry in delivering exceptional service.

How Delta Dental Insurance Works

Understanding how Delta Dental Insurance operates is essential for maximizing its benefits. Delta Dental works by partnering with a network of dentists who agree to provide services at negotiated rates. When you visit a participating dentist, you can expect reduced costs compared to out-of-network providers.

Delta Dental plans typically cover a range of services, including preventive care, basic procedures, and major treatments. Depending on the specific plan, coverage may vary, but most policies include:

- Regular check-ups and cleanings

- Fillings and extractions

- Root canals and crowns

- Orthodontic services (in some plans)

Policyholders are responsible for paying premiums and any applicable deductibles or co-pays. Delta Dental also offers flexible payment options to accommodate different budgets.

Read also:Dean Anderson Macgyver The Ultimate Guide To The Iconic Actor And Character

Structure of Delta Dental Plans

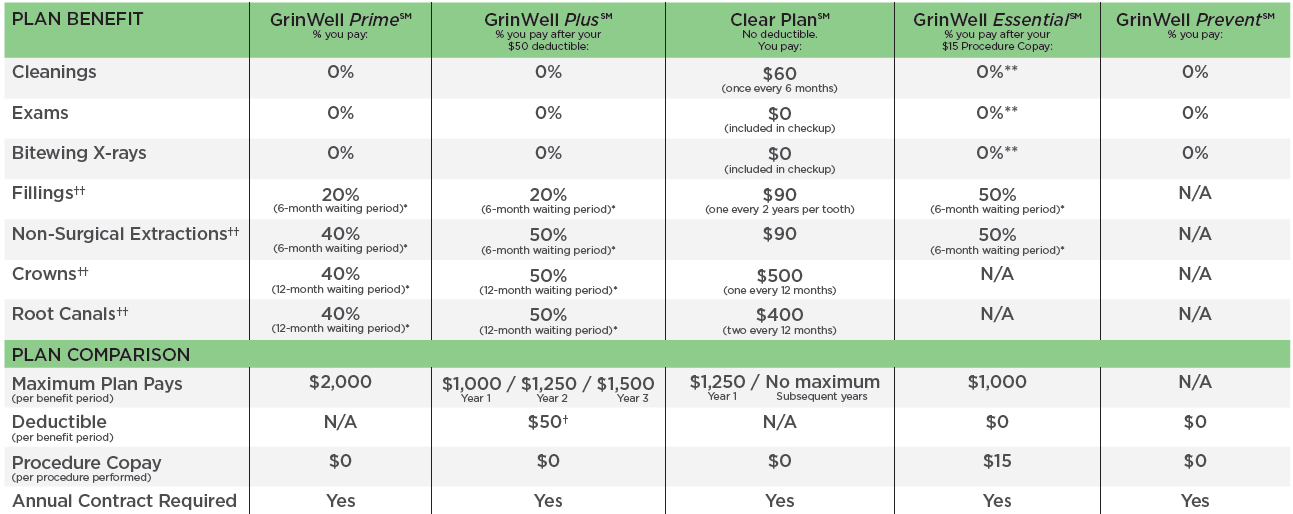

Delta Dental offers several tiers of coverage, each designed to cater to specific needs. These tiers include:

- Premier Plans: Comprehensive coverage with lower out-of-pocket costs.

- Preferred Plans: Balanced coverage with moderate premiums.

- Basic Plans: Essential coverage at an affordable price.

Each tier offers unique benefits, allowing policyholders to choose the plan that best fits their financial and healthcare requirements.

Types of Delta Dental Insurance Plans

Delta Dental provides a diverse selection of insurance plans to accommodate various lifestyles and budgets. Below are some of the most popular options:

Individual Plans

Designed for single individuals or small families, Delta Dental’s individual plans offer flexible coverage options. These plans are ideal for those who do not have access to employer-sponsored dental insurance or prefer personalized service.

Group Plans

Group plans are tailored for businesses and organizations looking to provide dental benefits to their employees. Delta Dental works closely with employers to design plans that align with their workforce’s needs and budget constraints.

Senior Plans

Recognizing the unique dental needs of seniors, Delta Dental offers specialized plans that focus on preventive care and age-related conditions. These plans often include additional benefits such as denture coverage and fluoride treatments.

Delta Dental's Network of Dentists

One of the standout features of Delta Dental Insurance is its extensive network of participating dentists. With over 150,000 dentists across the U.S., Delta Dental ensures that policyholders have access to quality care wherever they are. Dentists within the network agree to accept negotiated rates, which translates to significant savings for patients.

To find a participating dentist, policyholders can use Delta Dental’s online provider search tool. This tool allows users to filter results by location, specialty, and accepted insurance plans, making it easy to locate the right dentist for their needs.

While visiting an in-network dentist is highly recommended for cost savings, Delta Dental also offers out-of-network benefits for those who prefer to see a dentist outside the network. However, out-of-network visits may result in higher out-of-pocket expenses.

Coverage Benefits and Exclusions

Delta Dental plans provide comprehensive coverage for a wide range of dental services. Some of the key benefits include:

- Preventive care: Cleanings, exams, and X-rays

- Basic procedures: Fillings, extractions, and root planing

- Major procedures: Crowns, bridges, and root canals

It’s important to note that certain services may be excluded or subject to limitations. Common exclusions include:

- Cosmetic dentistry

- Experimental or investigational treatments

- Services not medically necessary

Policyholders should carefully review their plan documentation to understand what is covered and what is not.

Pre-Existing Conditions

Delta Dental typically does not exclude coverage for pre-existing conditions; however, there may be waiting periods for certain treatments. For example, major procedures like crowns or implants may require a waiting period before coverage kicks in. Understanding these waiting periods can help policyholders plan their dental care accordingly.

Cost Considerations for Delta Dental Plans

When evaluating Delta Dental Insurance plans, it’s crucial to consider the associated costs. These include:

- Premiums: Monthly or annual payments for coverage.

- Deductibles: The amount policyholders must pay before coverage begins.

- Co-pays: Fixed amounts paid for specific services.

- Coinsurance: Percentage of costs shared between the policyholder and Delta Dental.

Delta Dental offers tools to help estimate costs and compare plans, ensuring transparency in pricing. Additionally, the company provides discounts for paying premiums annually or enrolling multiple family members.

Eligibility Requirements for Delta Dental Insurance

Eligibility for Delta Dental Insurance varies depending on the type of plan. Generally, individuals and businesses in the U.S. are eligible to enroll, provided they meet the following criteria:

- Residency in a state where Delta Dental operates

- Proof of identity and age

- Timely payment of premiums

Some group plans may have additional eligibility requirements set by the employer or organization offering the coverage.

Enrollment Periods

Delta Dental offers open enrollment periods for group plans, during which employees can sign up for coverage. Outside of these periods, individuals may qualify for special enrollment due to life events such as marriage, birth, or job loss. Individual plans are typically available year-round, subject to underwriting approval.

How to Enroll in Delta Dental Insurance

Enrolling in Delta Dental Insurance is a straightforward process. Policyholders can sign up online, over the phone, or through a licensed insurance broker. Below are the steps to enroll:

- Visit Delta Dental’s official website or contact customer service.

- Select the appropriate plan based on your needs and budget.

- Provide necessary information, including personal details and payment information.

- Review and confirm your enrollment.

Once enrolled, policyholders will receive a welcome kit containing important documents, including an ID card and plan details.

Delta Dental Customer Support

Delta Dental prides itself on offering exceptional customer support to ensure a seamless experience for all policyholders. The company provides multiple channels for assistance, including:

- 24/7 phone support

- Online chat and email

- Self-service tools on the Delta Dental website

Customer support representatives are trained to address inquiries related to billing, claims, and provider networks. Additionally, Delta Dental offers educational resources to help policyholders better understand their coverage and maximize benefits.

How to File a Claim

While Delta Dental processes claims automatically when visiting in-network providers, policyholders may need to file claims manually for out-of-network services. To file a claim, gather the necessary documentation, including:

- A completed claim form

- Itemized bills from the dentist

- Proof of payment

Submit the completed paperwork via mail or upload it through the Delta Dental portal. Claims are typically processed within 30 days.

Conclusion: Why Choose Delta Dental?

Delta Dental Insurance stands out as a leader in the dental benefits industry, offering comprehensive coverage, extensive networks, and personalized service. Whether you’re an individual seeking affordable dental care or a business looking to enhance employee benefits, Delta Dental has a plan to suit your needs.

By understanding the intricacies of Delta Dental plans and leveraging its resources, you can take proactive steps toward maintaining optimal oral health. We encourage you to explore Delta Dental’s offerings further and consult with a licensed agent for personalized guidance.

Don’t forget to share this article with others who may benefit from it and leave a comment below with your thoughts or questions. For more informative content, check out our other articles on health and wellness topics.

References:

- Delta Dental Official Website

- U.S. Department of Health & Human Services

- American Dental Association