Auto insurance is a crucial aspect of responsible driving, and GEICO offers some of the most competitive policies in the market. Whether you're a seasoned driver or a newcomer, understanding auto insurance can significantly impact your financial well-being. GEICO, one of the leading insurance providers in the United States, is known for its affordable rates and excellent customer service. In this article, we will delve into the intricacies of GEICO auto insurance, helping you make an informed decision.

Driving without insurance is not only illegal in most states but also poses significant financial risks. GEICO has been a trusted name in the insurance industry for decades, offering various coverage options tailored to meet individual needs. From liability coverage to collision and comprehensive protection, GEICO ensures that its customers are well-protected on the road.

Whether you're looking for ways to save money on your premiums or seeking advice on choosing the right policy, this article will provide you with comprehensive insights. Let's explore the world of GEICO auto insurance and discover why it's one of the top choices for millions of Americans.

Read also:Ethan Precourt A Comprehensive Guide To Understanding The Rising Star

Table of Contents:

- Introduction to GEICO

- Types of Coverage Offered by GEICO

- Benefits of Choosing GEICO

- How to Save Money with GEICO

- GEICO Customer Service

- The Claims Process with GEICO

- GEICO Discounts and Promotions

- Comparison with Other Providers

- Tips for New Drivers

- Frequently Asked Questions

Introduction to GEICO

GEICO, which stands for Government Employees Insurance Company, was founded in 1936. Initially catering to government employees, GEICO has grown to become one of the largest auto insurance providers in the United States. Known for its straightforward policies and competitive pricing, GEICO serves millions of customers across the country.

History of GEICO

GEICO's journey began with a vision to provide affordable insurance to government employees. Over the years, the company expanded its offerings and customer base, becoming a household name in the insurance industry. Today, GEICO offers a wide range of insurance products, including auto, motorcycle, boat, and home insurance.

Why Choose GEICO?

There are several reasons why drivers opt for GEICO. The company is renowned for its:

- Affordable premiums

- Comprehensive coverage options

- Exceptional customer service

- Wide network of agents and representatives

Types of Coverage Offered by GEICO

GEICO provides a variety of coverage options to ensure that drivers are adequately protected. Below are some of the key types of coverage available:

Liability Coverage

Liability coverage is mandatory in most states and protects you against damages or injuries caused to others in an accident. GEICO offers both bodily injury liability and property damage liability coverage.

Read also:Slice Merchant Services Revolutionizing Payment Solutions For Businesses

Collision Coverage

This type of coverage pays for damages to your vehicle resulting from a collision with another object or vehicle. Collision coverage is particularly useful for newer cars.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters. GEICO ensures that your car is safeguarded against unforeseen events.

Benefits of Choosing GEICO

Choosing GEICO comes with numerous benefits that make it a popular choice among drivers. Here are some of the advantages:

- Competitive pricing

- 24/7 customer support

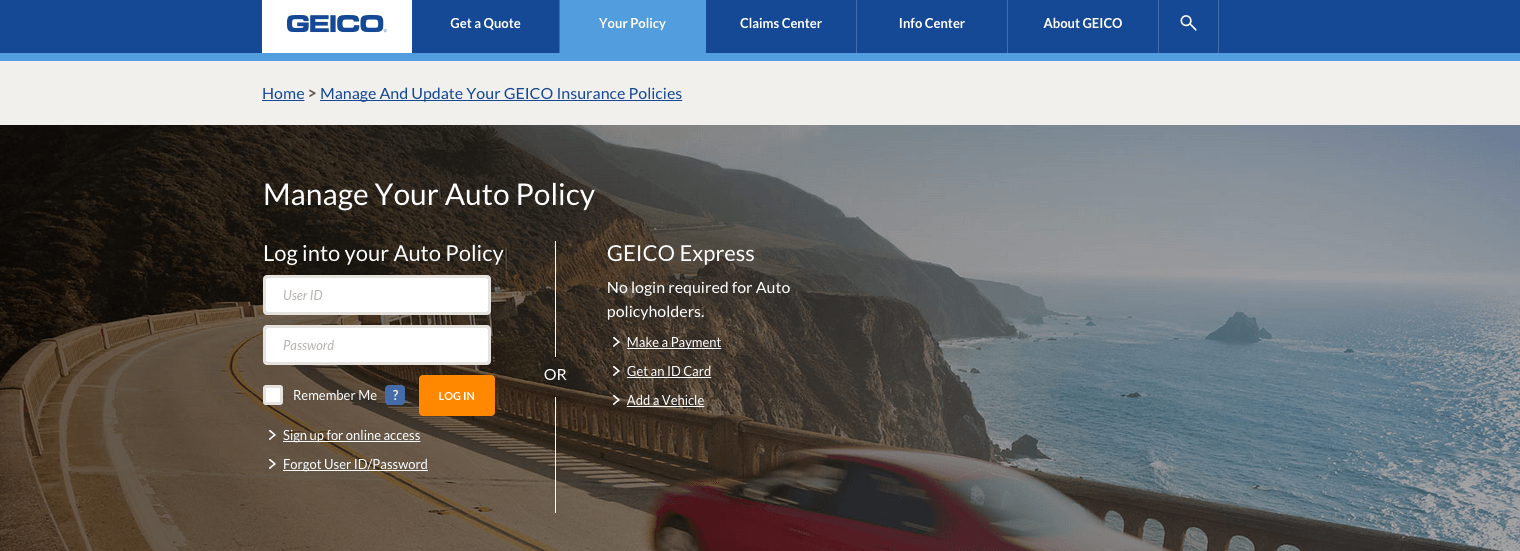

- Convenient online services

- Wide range of discounts

GEICO's commitment to customer satisfaction is evident in its services and offerings. Whether you need assistance with your policy or have questions about coverage, GEICO is there to help.

How to Save Money with GEICO

One of the primary reasons drivers choose GEICO is the potential to save money on their insurance premiums. Here are some strategies to help you reduce costs:

- Bundle multiple policies for discounts

- Maintain a clean driving record

- Take advantage of loyalty programs

- Opt for higher deductibles when appropriate

By implementing these strategies, you can enjoy significant savings while maintaining comprehensive coverage.

GEICO Customer Service

GEICO prides itself on its exceptional customer service. Whether you need assistance with policy changes, billing inquiries, or claims, GEICO's customer service team is available 24/7 to assist you. Their representatives are knowledgeable and dedicated to resolving any issues you may encounter.

Customer Service Channels

GEICO offers multiple channels for customer support, including:

- Phone

- Live chat

- Mobile app

These options ensure that you can reach out to GEICO at your convenience.

The Claims Process with GEICO

Understanding the claims process is essential for any policyholder. GEICO makes it easy to file a claim through its user-friendly platform. Here's a step-by-step guide:

- Contact GEICO immediately after an accident

- Provide necessary details and documentation

- Wait for the claims adjuster to assess the situation

- Receive settlement or repair estimates

GEICO's efficient claims process ensures that you receive the compensation you deserve promptly.

GEICO Discounts and Promotions

GEICO offers a variety of discounts to help you save on your premiums. Some of the notable discounts include:

- Safe driver discount

- Military discount

- Good student discount

- Multi-policy discount

Eligibility for these discounts may vary based on individual circumstances, so it's essential to inquire about the options available to you.

Comparison with Other Providers

When choosing an insurance provider, it's important to compare options. GEICO stands out due to its:

- Competitive pricing

- Wide range of coverage options

- Excellent customer service

While other providers may offer similar features, GEICO's reputation and history make it a top choice for many drivers.

Tips for New Drivers

New drivers can benefit from the following tips when selecting GEICO auto insurance:

- Start with basic coverage and upgrade as needed

- Enroll in a safe driving course for discounts

- Shop around for the best rates

- Understand your policy terms and conditions

These tips can help new drivers navigate the complexities of auto insurance and make informed decisions.

Frequently Asked Questions

Here are some common questions about GEICO auto insurance:

How do I get a quote from GEICO?

You can obtain a quote from GEICO by visiting their website, calling their customer service number, or visiting a local office.

What factors affect my premium?

Your premium is influenced by factors such as your driving record, vehicle type, location, and coverage options.

Can I bundle my policies with GEICO?

Yes, GEICO offers discounts for bundling multiple policies, such as auto and home insurance.

What should I do if I'm involved in an accident?

Contact GEICO immediately and provide them with the necessary details. They will guide you through the claims process.

Kesimpulan

In conclusion, GEICO is a reliable and affordable choice for auto insurance. With its comprehensive coverage options, competitive pricing, and excellent customer service, GEICO continues to be a favorite among drivers. By understanding the various aspects of GEICO auto insurance, you can make an informed decision that aligns with your needs and budget.

We encourage you to share this article with others who may find it helpful. For more information on auto insurance and related topics, explore our other articles. Your feedback and questions are always welcome!